Is trend following dead in the water? Has the concept stopped working? Are we seeing the death of the CTA industry and a return to traditional investments? Fair questions. Let’s look closer before answering them. The industry is certainly going through a very tough period. This is the second bad year in a row and the cumulative drawdowns are adding ...

Read More »Author Archives: Andreas Clenow

August CTA Performance Roundup

Trend following hedge funds mostly showed small changes in August. A few however showed rather large swings. August was a month where the asset mix really mattered. I have stated before that the key factor separating these funds is asset mix. The entry and exit rules are more or less the same for all trend followers. Tweaking the details is ...

Read More »Flat August after Bonds Stopped Early

Trend followers will show quite mixed performance for August. Most months are about the overall picture. This month was all about the tiny details. August was a rare month where luck made the difference between up or down. Have you ever taken a stop on a trade only to see it turn right back up again? This is what happened ...

Read More »Leverage Schmeverage!

Is it risky to be 150% leveraged? How about 1500%? It’s the wrong question to ask. Leverage and risk are not necessarily connected. A common argument against trend following hedge funds is that they are too leveraged. This is based on a lack of understanding of leverage. Most people who bring up this argument are just used to one asset ...

Read More »How to Rob Commodity Investors

The Setup Equities live forever. It’s a close enough approximation at least. Futures on the other hand have a very short life span. This creates some unique problems. And some even more unique opportunities. Each futures contract has a predefined date of death. Expiry date as the industry euphemism goes. The 2012 September EuroStoxx contract expires on September 21 and ceases to ...

Read More »Strong July Trend Following Performance

It’s been a rocky year for trend followers so far and our core strategy is just barely above zero for the year. July was very good and so far all CTA funds I follow came in with strong numbers, as could be expected and predicted by the core strategy. Early in the year the trend followers as a group were ...

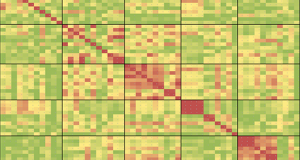

Read More »How to Build Correlation Matrices

They key to trend following is to be very diversified, so that your return curve moves up in a reasonably smooth manner. What you need to ask yourself however is whether you are holding a real diversified portfolio or just a very expensive illusion of safety. Everyone talks of increasing correlations the new risk on/risk off world, but few topics ...

Read More »Grains Trends Going Parabolic

USAWH27NBAX9 After having had a bad run most of the year the grains trends started taking off in late June and it is still going strong. For a long time earlier in the year, the core trend following trading system was actually short the grains and even made money on that trade but now the situation is very different. The ...

Read More »Interactive Futures Chart

When you deal with futures trend following it is imperative that you have properly adjusted time series to analyze or you will not get any meaningful results. Our new interactive futures charts are of course fully adjusted and covering all asset classes and all major instruments. Did you ever want to analyze the long term performance of live cattle? How ...

Read More »Tough First Half of 2012

The first half of 2012 has been challenging for trend followers and the results of most CTA funds is in the red. The problem this year has been the lack of proper trends across asset classes and the single mindedness of the market’s risk-on / risk-off approach. There has really only been one core trend this year, which is long ...

Read More »Core Strategy Betting on the Downside

There has been some rather interesting volatility so far this year in the trend following business. As of end of April several funds hit their all time largest drawdowns and an overwhelming majority of all the trend funds were heavily down. In May things looked a little better, where the long bond trade really paid off for those who dared ...

Read More »Bonds Making the Difference

It’s been a tough year so far for trend following futures traders and quite a few CTA funds are at or near their maximum drawdown levels. With the large moves for many players in the past few months and the big discrepancy between the top and bottom performers, one has to stop to ask what’s going on here. Let’s start ...

Read More »Equities Rising

You may have noticed that we are getting more and more long equity positions lately. We are now up to a total of 9 markets in this sector in this category for quite an aggressive long equity exposure. Seemingly contradictory, we still hold a large allocation of long rates as well and it is likely that one of these bets will ...

Read More »The Long Everything Portfolio

The current trend following portfolio has a very clear tilt towards the long side of, well, just about everything. We are long rates, long equities, long metals, long energies and even a little bit of long agriculturals. To be fair, we also have a few short positions but they are rather the exception at the moment. There is also quite ...

Read More »Unnatural Gas

Supposedly there are no exploitable market anomalies since they would all have been destroyed by hedgers the instant they appeared. Well, that is at least what many text books would claim but if you are working in this business you already know better. One of the most oddly persistent anomalies and therefore one of the more interesting trade situations for ...

Read More »Portfolio Diversification Increasing

It has been a tough year for diversified futures traders. Most big name funds lost money last year and the whole industry suffered from the binary risk on/risk off scenario we have been seeing during much of last year. Our core DFT strategy had a less than stellar run but it kept up with competition and it never saw any ...

Read More »Are we starting to decouple?

Decouple. The most overused word in financial analysis letters. An in hard competition at that. We are not looking at a full decouple for sure, but what we see lately is a little bit less correlation between asset classes and possibly the beginning of the end or at least at respite in the whole ‘risk on/risk off’ regime. For the ...

Read More »Long Rates? Really? On these Levels?

The observant reader may have noticed that we have been scaling out of the short agriculturals lately, as several stops have been taken out. That theme was dominating the portfolio in December and we still hold some exposure to it, but it no longer is the core driver of the portfolio. It is in the nature of a trend following ...

Read More »Year Review 2011

Year Return: -5.91% (after commissions, slippage, 2% fixed fee) Historically, years with turbulent equity markets and global crises has meant strong performance for diversified futures but this year was different. Clearly the trend followers struggled during 2012 and we have to ask ourselves what went wrong and why. The performance is not in any way out of proportions in regards ...

Read More »Strategy Moves into the Red

The past few days we have seen a general counter trend market where practically all trends were bucked. The dollar attempted a break on the upside but was pushed back down, the agricultural commodities gained on the dollar weakness as did the non-agricultural ones and as the equity markets saw a couple of positive days the rates futures declined. This ...

Read More » Following the Trend

Following the Trend