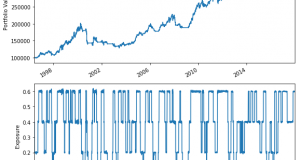

In the past year, that is by far the most common question I get. Now that Quantopian went the way of the Dodo, is Zipline dead? Should we switch to a different backtesting engine? The short answer is that the rumors of Zipline’s demise are exaggerated, but let’s take it from the start. My 2019 book Trading Evolved focuses on ...

Read More »Author Archives: Andreas Clenow

A Stab at Fiction

I’m excited to announce the launch of my debut novel! When I wrote my first book a decade ago, I didn’t expect it to get much attention, or sales. I was in the wrong country, of the wrong nationality, I had shunned social media and was nearly invisible on the internet. On top of these obstacles, I tried out a ...

Read More »A Brand New Analysis Toolkit

We’ve got some exciting news! We’re finally ready to share a new project that we’ve been working on for some time! It’s a brand new, modern trading analysis website aiming to help you improve your trading and expand your knowledge. We’ve been meaning to make a new and modern trading site for some time now. After all, what sense does ...

Read More »Zipline in Docker – Guest Article

Zipline in Docker This article is contributed by Henrik Nilsson, a clever Swedish guy who read my book and rightly pointed out that I should have mentioned something about how Docker can help simplify the process of setting up and running Zipline. I very much recommend reading and following the instructions below. Having had limited experience with Docker myself, I ...

Read More »Why I’m rejoining the CMT

Back in 2014 I wrote some articles on the subject of technical analysis and the CMT Association, previously known as the MTA. I spoke my mind in the belief that quite few people would read it and even fewer would care. I had no idea that these articles would get quite a wide circulation and cause a bit more commotion ...

Read More »Leveraged Trading

I tend to be a little skeptical when I see books aimed at retail traders with low amount of trading capital, focusing on leveraged trading on FX, CFDs and the like. The very mention of retail forex trading means that there’s a near certainty that whatever comes next is misinformed at best and a scam at worst. But seeing my ...

Read More »Trading Evolved – Errata and Updates

A book like Trading Evolved will without a doubt have errors. On top of errors, updates may also be needed as new versions of dependent software packages are released. I will keep a running log on this site of issues found, and suggested solutions. After this list grows long enough, I will update the book itself, and put a version ...

Read More »Have you ever wondered what a Swiss Banker does?

Not long ago, I came across a newly released book. I nearly ignored it as I didn’t really like the title, but the cover grabbed my attention. On the cover, there was a photo taken a couple of hundred yards from my office, in central Zurich, with plenty of big Swiss flags on it. Must be taken on National Day. ...

Read More »Trading Evolved – Taking it to the Next Level

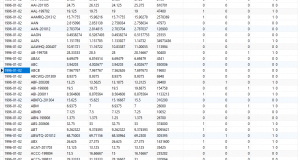

A year in the making, my third book is now complete. Trading Evolved is quite different from my previous books, and substantially more information packed. This book is a practical, in-depth guide on how to backtest and analyze strategies using powerful Python techniques. To my knowledge, no such book exist at the moment. Trading Evolved is a trading book. Not ...

Read More »Trading Sardines

Hey everyone. Remember me? It’s been a while. I’m glad to see that you’re still around. I’m sorry for the radio silence in the past year. It was for many reasons, a strange year. At first, I had a bit of a health scare in the first part of the year. I won’t scare you with the details, but while ...

Read More »Complex Backtesting in Python – Part II – Zipline Data Bundles

Please Login to view this content. (Not a member? Join Today!)

Read More »Complex Backtesting in Python – Part 1

Please Login to view this content. (Not a member? Join Today!)

Read More »Backtesting with Python

Please Login to view this content. (Not a member? Join Today!)

Read More »How to Become a Professional Trader

Would you like to trade for a living? Of course you do. That’s why you are here, reading this article. Professional trading is the subject of much lore and myths, and it can be difficult sometimes to tell reality from fiction. Before you read this article, you need to make a decision. Do you want to become a professional trader? ...

Read More »Target Percent Allocation and Other Tricks

Please Login to view this content. (Not a member? Join Today!)

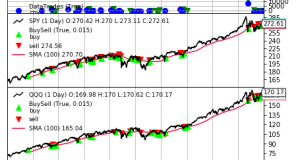

Read More »Separating Positions from Allocations

Most trading models I see are missing an important concept. It’s not a terribly difficult concept, but it is an important one. It’s not at all strange that most traders, in particular on the retail side, are missing this point. Most trading books skip over it. Most books gloss over it, or just don’t mention it at all. My books ...

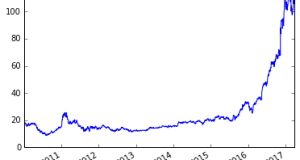

Read More »Volatility Parity Position Sizing using Standard Deviation

Please Login to view this content. (Not a member? Join Today!)

Read More »Breaking into the Financial Industry

Please Login to view this content. (Not a member? Join Today!)

Read More »Getting Started with Python for Finance

Please Login to view this content. (Not a member? Join Today!)

Read More »Why I Left a Comfortable Management Career

In what now seems like a past life, I had a cushy management career with a large financial data provider. I was doing well, advancing fast in the company. Yet I left it all behind and took a chance on something new and unknown. Knowing how it all turned out, I don’t regret it for a moment. Actually, even if ...

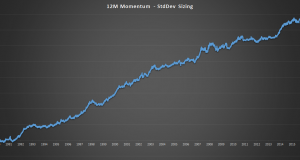

Read More » Following the Trend

Following the Trend