The Setup

They’ll never know what hit them.

Equities live forever. It’s a close enough approximation at least. Futures on the other hand have a very short life span. This creates some unique problems. And some even more unique opportunities.

Each futures contract has a predefined date of death. Expiry date as the industry euphemism goes. The 2012 September EuroStoxx contract expires on September 21 and ceases to exit. If you had bought this and want to keep being long this asset you would now need to roll into the next month. So you would sell the September and buy the December. So far, so easy.

With commodities things get slightly more tricky. You can never hold a commodity futures until expiry. Unless of course you don’t mind having a truck load of pigs delivered to your office. Instead you need to be out before the First Notice Date. Terminology aside, the principle is the same. The contract will not live for long and you need to move on to the next contract.

At any given time there will be a number of tradable contracts for each market. They will have varying levels of liquidity and normally one of them is massively more liquid that the rest. Ok, still just basic futures information. How does this relate to stealing from commodity investors?

The Mark

Serial bank robber Willie Sutton was once asked why he robbed banks. His response was plain and simple. “Because that’s where the money is.” Guess where else there is money? Long only commodity funds.

This multi-billion dollar industry targets investors who wants to put their money in commodities. They simply buy the physical commodity and sit on it for the long run. No, not really. Doing that would require a massive warehouse and transportation operation. What they really do is buy futures. And when they get close to their end of life, they simply roll them into the next liquid month.

Who invests in these funds? Anyone who lacks understanding of term structures. Easy marks.

Sometimes big is an advantage. For a commodity futures investor it is not. It makes you predictable. With very high degree of accuracy one could easily predict that these investors will get ripped off. After all, a fool and his money is lucky enough to get together in the first place.

The Heist

Volume moves east. Price moves South West.

We know that these funds must be long all the time. We also know that they must hold the most liquid contract. They are simply too large to be in anything else. It’s not difficult to see when the volume starts moving from one contract to the next. Therefore we know when these behemoth funds need to trade.

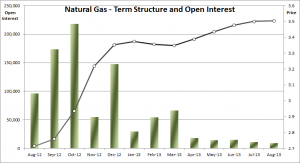

They are long the liquid contract so we need to be short it. How do we find the liquid contract? Just look at the open interest. We need to enter into this short just before The Great Migration begins. This is also easily predictable.

But just being short this contract is not enough. It would leave an open market risk which would dominate the trade. We need a long leg of the trade as well. Either the next candidate for top liquidity or a combination of points to the right on the curve. Balance the legs to even out market effects. What you have left is a calendar spread.

The funds sell the points to the left. At the same time they buy to the right. Their footprint is large enough to temporarily distort the term structure. Not by much but enough. Do it on many markets. Do it every month. You will win some and lose some. But you will have a statistical advantage. You will slowly siphon money from the long commodity investors.

The Getaway

Every good heist comes with risks. To get away with enough cash you need large positions. The notional exposure may seem north of crazy. Just like when robbing a bank exact timing and precision is needed. One sloppy execution and it may all be for nothing. The trade that is. Synchronize your watches. Stick to the plan. No improvisation.

Competing Crews

Ironically the most fierce competing gang for the investors’ money is the funds themselves. They have a nice scheme going playing the long con. They have spent much time and resources on this con. They actually got people to pay them management fee for buying and holding commodity futures. They buy high up on the right side of the term structure. They ride the contango down the curve before buying high again. And they got the investors to believe they will get the same return as holding the physical assets.

These guys are good.

Following the Trend

Following the Trend