March was in most regards a slow month. Only one sector showed persistent trends and this was the normally troublesome equities market. The key trend was of course still the whole Japan complex, fueled by a decisive central bank. Most trend followers have been long the Nikkei, short the JY, long the RY and probably a few more similar related bets. These trends have been scary for the past months but scary in a good way. They just never seem to want to stop going parabolic.

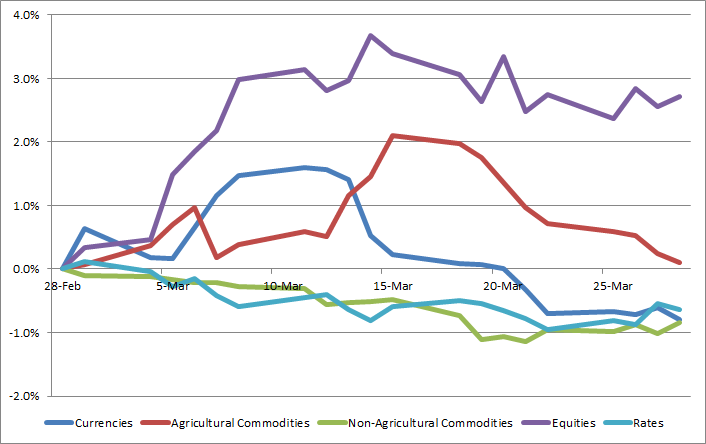

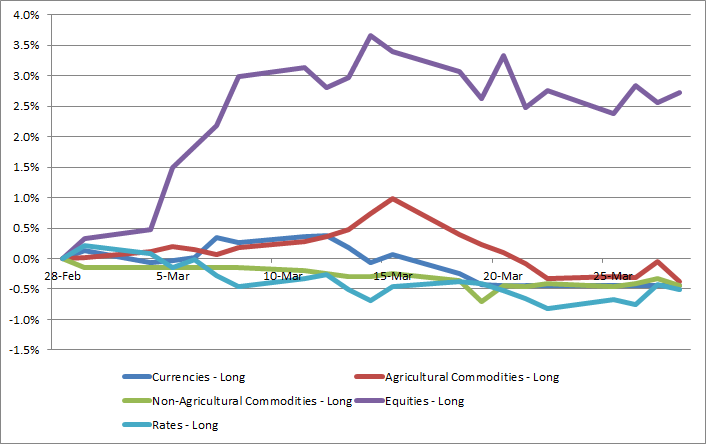

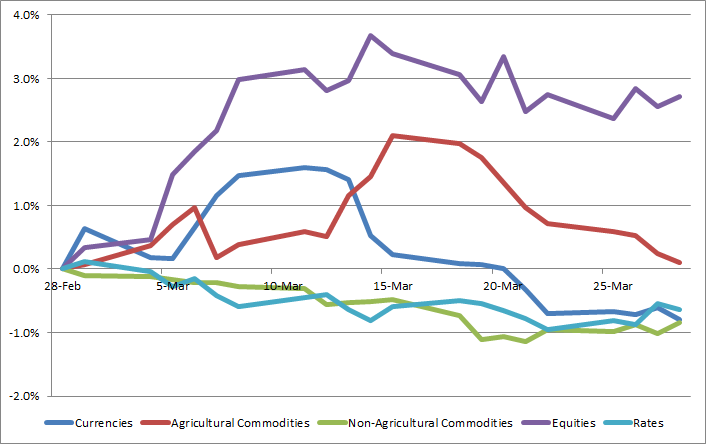

The Core Strategy from Following the Trend ended the month at just about half a percent up. As usual, the gains came from the long side of the trading. The charts show you the impact of the equity sector and the relative insignificance of the others. The short agricultural commodities had a good run for a while, as did the short currencies, but they both ended up giving most away.

As for the trend following hedge funds, they are showing the same pattern. Generally they are up but with a few exceptions they were not moving much in March. The difference in time horizon for Mulvaney compared to most others is becoming more and more apparent. They generally take a much longer view on trends than most others. This caused them to suffer deeper losses than most the past years but it’s also helping them making a very strong comeback. The long time horizons can be very scary and cause deep drawdowns at times, but in the long run the longer time frames are usually generating a much higher return.

| Fund | March | 3 Months | 6 Months | 9 Months | 1 Year | 2 Years |

|---|---|---|---|---|---|---|

| Mulvaney Global Markets | 9.4% | 29.8% | 9.9% | 5.0% | -15.7% | -23.8% |

| Robinson Langley | 3.6% | 3.3% | -16.1% | -16.6% | -23.4% | -40.1% |

| Eclipse Global Monetary | 3.3% | 11.2% | 10.5% | 15.6% | 14.0% | 13.4% |

| DUNN WMA | 3.2% | 20.3% | 19.0% | 14.0% | 9.5% | 7.5% |

| Sunrise Capital Diversified | 3.2% | 1.3% | -7.4% | -10.2% | -21.1% | -22.8% |

| Fort Global Diversified | 2.8% | 2.4% | 1.5% | 7.9% | 8.9% | 54.1% |

| Winton Diversified | 2.7% | 5.4% | 5.1% | 6.0% | 2.5% | 6.1% |

| Quantica Managed Futures | 2.4% | 7.9% | 4.9% | 6.1% | 0.9% | 12.0% |

| Quicksilver Diversified | 2.0% | -0.2% | -1.6% | -6.4% | -14.2% | -33.9% |

| Superfund Green | 1.8% | 6.0% | -2.6% | -5.8% | -2.1% | -23.0% |

| Clarke Capital Worldwide | 1.6% | 6.3% | 6.8% | 13.6% | 31.5% | 19.8% |

| Chesapeake Diversified | 1.5% | 6.2% | -2.0% | -3.1% | -9.0% | -29.1% |

| Estlander Alpha Trend | 1.5% | 10.9% | 1.0% | 1.6% | 3.5% | -12.5% |

| Transtrend Diversified Standard Risk USD | 1.4% | 0.6% | -2.0% | -2.1% | -0.6% | -4.8% |

| M S Capital Global Diversified | 1.4% | 0.2% | -5.6% | -6.0% | -11.9% | -31.2% |

| ISAM Systematic Fund | 1.1% | 0.5% | -5.6% | -7.5% | -13.0% | -20.7% |

| Eckhardt Standard Plus | 1.1% | 3.4% | -5.7% | 3.9% | 6.9% | -10.6% |

| CampbellGlobal Diversified Large | 1.1% | 5.3% | 0.0% | 3.4% | 3.7% | 6.2% |

| Welton GDP Program | 1.0% | 2.5% | -3.0% | -2.0% | -4.6% | -20.6% |

| John Locke Cyril Systematic | 1.0% | -0.8% | -4.8% | -3.0% | -3.0% | -9.6% |

| IKOS Futures Fund | 0.9% | 0.2% | -1.7% | -1.2% | -2.9% | -11.9% |

| AIMhedge GDF Classic | 0.7% | 2.9% | 1.3% | -1.8% | -2.6% | -7.5% |

| Conquest Managed Futures Select | 0.6% | 3.1% | -1.0% | -1.3% | -1.9% | -11.5% |

| Abraham Diversified | 0.5% | 0.5% | -2.4% | -0.7% | 1.9% | -7.9% |

| IKOS Hedge Fund | 0.2% | 1.0% | 1.1% | 0.8% | -1.3% | -10.0% |

| Kaiser Trading Group | 0.1% | 1.2% | -1.5% | -2.6% | 1.9% | -4.2% |

| NuWave Combined Futures Portfolio | 0.0% | -2.1% | -4.5% | -11.9% | -13.0% | -7.8% |

| Rabar Diversified Program | 0.0% | 0.3% | -8.4% | -7.6% | -5.0% | -17.7% |

| Hyman Beck Global Portfolio | -0.2% | 0.6% | 2.0% | -4.8% | -13.7% | -27.0% |

| Adamah Diversified Program | -0.3% | -2.1% | -3.9% | -5.2% | -8.5% | -21.3% |

| Quality Global Diversified | -1.2% | 0.5% | -10.1% | -2.7% | -7.5% | -22.1% |

| Heyden Steindl TOMAC2 | -3.9% | -6.3% | -3.4% | 5.2% | 11.0% | -13.4% |

I’d like to thank everyone who bought my book and who helped keep it as the number 1 best selling futures book for the past few months. In particular I’d like to thank all of you who contacted me with your feedback and who wrote reviews on Amazon. I had not expected such an overwhelmingly positive response from readers and it’s great to hear from you all.

If you haven’t already signed up, take a look at our new web initiative, Tradersplace.net. It’s completely free and it will remain completely free. We are a couple of professional traders who got together to try to create a more friendly, more personal and more professional community site for traders. We had a tremendous growth so far and the site is developing rapidly.

Following the Trend

Following the Trend