The idea of exchange traded funds (ETF) is great. It made perfect sense to create them and they did a great service to the general public. Yet, as financial products often do, they have mutated into veritable financial landmines. When you look to invest in ETFs, be careful. Be very careful.

The idea of exchange traded funds (ETF) is great. It made perfect sense to create them and they did a great service to the general public. Yet, as financial products often do, they have mutated into veritable financial landmines. When you look to invest in ETFs, be careful. Be very careful.

What’s good about ETFs

Almost all mutual funds consistently fail to beat their benchmark. The S&P mutual fund reports tracks the performance of mutual funds versus their indices. Here are some highlights:

- Of all US equity funds, 78.9% failed to beat their benchmark over the past three years.

- Of all US large-cap equity funds, 92.1% failed to beat their benchmark over the past three years.

- Of all US mid-cap equity funds, 92.9% failed to beat their benchmark over the past three years.

- Of all real estate funds, 95.1% failed to beat their benchmark over the past three years.

Wait a minute, aren’t these mutual funds taking huge fees and paying millions to fund managers? Yeah, and that’s a large part of the reason why they are underperforming. The banks take out high fund fees and let their own brokerage arm do the trading at high commissions, making it a very profitable business for everyone involved. Except the investor who has about ten percent chance of reaching the same return as the general market.

Enter ETFs. The idea of ETFs was to provide a passive way to follow an index with a great deal of precision. Instead of having a fund manager meddle with the strategy, the original ETFs simply had a computer invest in the same shares as the index, at the same weights. Having an automated setup like that means very little cost, and the fee structure of these ETFs is very low. For the SPY for instance, which tracks the S&P 500, the net expense ratio is 0.0945%. Yes, that means that every year you’ll get the return of the S&P 500 index, minus 0.0945%. That will end up beating over 90% of all the highly paid active mutual fund managers.

So ETFs do serve a purpose. The idea is great. Normal ETFs are not a problem.

Structured products masquerading as ETFs

The real problem is that as ETFs gained a nice reputation for being a safe and prudent investment vehicle, the business started relabeling any junk as ETFs. Worst of all, they started selling structured products to retail clients who don’t know what structured products are. And they called them ETFs because the term structured product has a bad reputation after they almost destroyed the world a few years ago. These ETFs usually have deceptive names to trick the unsuspecting investor.

One of the worst types of offenders are the short ETFs, also called inverse ETFs. If an ETF is marketed as Short S&P 500, you’d think it’s a pretty straight forward instrument. If the index goes down ten percent, you gain ten percent. No. Doesn’t work like that.

The short ETFs rebalance daily. For anyone who dealt in structured products or traded options, that should already make the picture clear. This is a huge deal.

The design of these instruments is to match the percentage return on a single day.

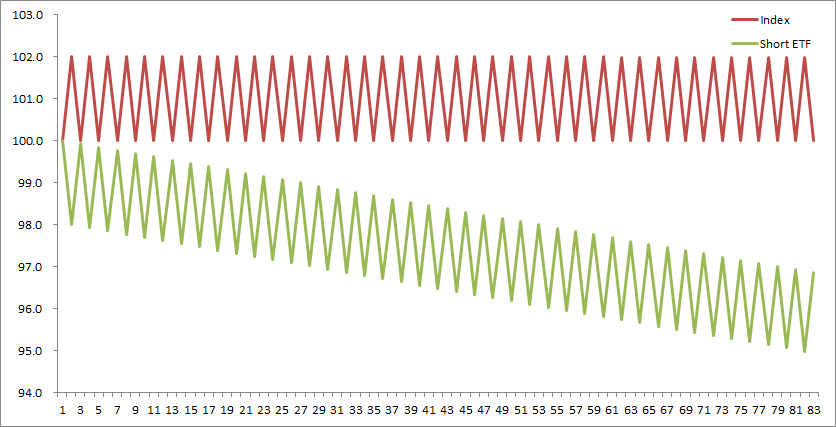

Let’s illustrate the problem with very simple math. Imagine that the index moves up by 2% every second day and down by 1.961% every second day. This means that the index will keep going from 100 to 102, back to 100 etc. So index is heading sideways with quite small moves. Would you expect your short ETF to head sideways too? It won’t.

This is what the short ETF will do. This is very simple math. The both start at 100. First day, index is up 2%. Index is at 102, short ETF at 98. Then the index falls by 1.961%, and it’s back to 100.0. The short ETF on the other hand is at 99.92 (98*1.01961).

Short ETFs are a volatility play. You are trading gamma.

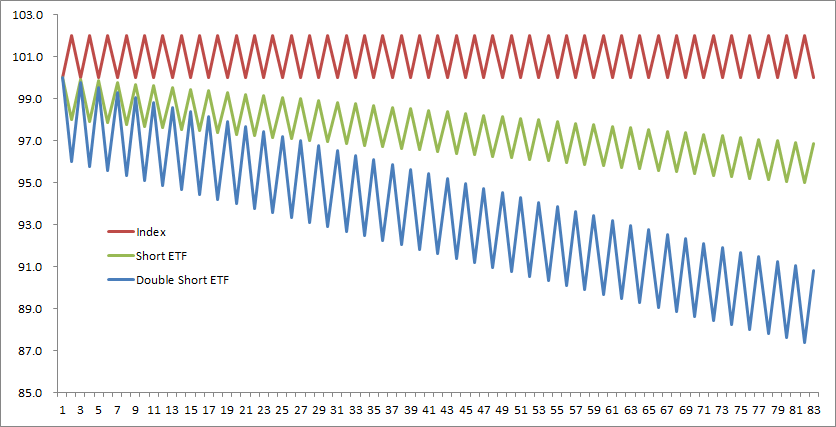

So what about those popular double short ETFs? Well, they seem to be designed for those with more money than math knowledge to help correct that imbalance. Here’s what would happen in the exact same scenario as above. Keep in mind that these charts are before fees, so in reality you’d get even less.

A completely sideways market for 83 days, and the double short lost 15%.

Here’s how the short ETFs work:

- If the market goes up, you lose.

- If the market goes sideways, you lose.

- If the market goes down a little, you lose.

- If the market goes down a lot under heavy volatility, you still lose.

How short ETFs would have lost your money in real life

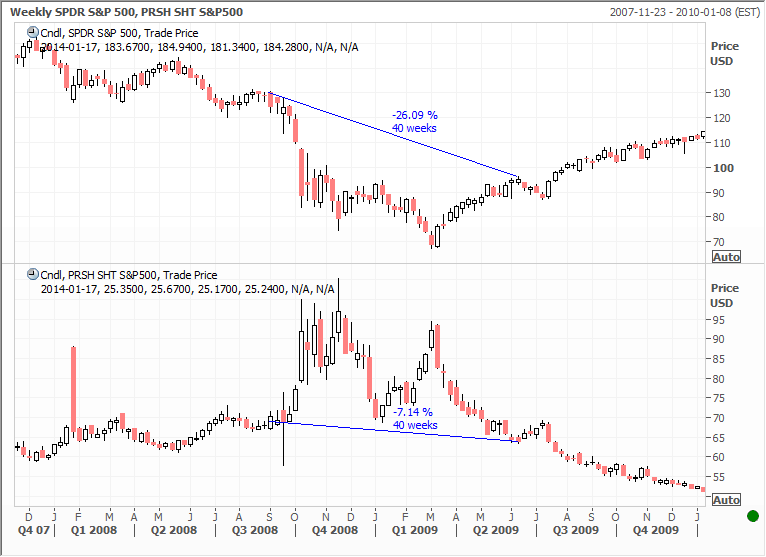

Let’s start with the obvious one. Some is probably eager to point out how useful these short ETFs can be in a severe bear market, like in 2008. With some extreme timing skills, you could have made short term money with these instruments. But you could have done that with actual short positions in the actual index as well without the gamma exposure.

The chart below shows the SP500 index as the top and the short ETF on the same index below. Not the double short, just the standard one.

If you had been in the short ETF during that 26% decline in price, your profits on the short ETF would have been… wait a minute… you would have lost 7%!

The impact gets more extreme the higher the volatility of the underlying index is. Obviously, since you’re taking a short gamma trade. Let’s look at a some really insane ETFs.

This is the triple short S&P tracker. It lost 98% since inception.

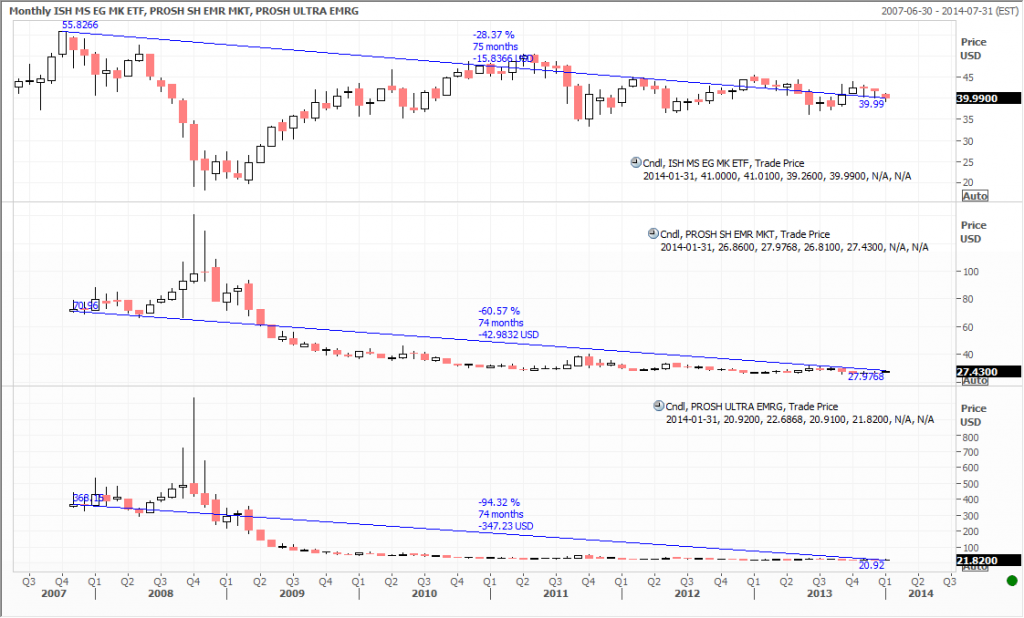

Still not crazy enough? How about the MSCI Emerging Markets?

In late 2007 Proshares launched a short and a double short ETF on this index. Since then the index is down 28%. Now that should mean some nice profits for those short ETFs, right?

The index is at -28%. The short ETF is at -60%. The double short is at -94%.

So why do they sell ETFs that are mathematically bound to lose?

Because people buy them.

It certainly doesn’t help that the Internet is full of bloggers without knowledge of this area who keeps recommending them. The core problem is that these instruments sound like a good idea. But they just aren’t.

Following the Trend

Following the Trend

Much has been written about volatility decay in regards to ETFs, particularly dangerous in leveraged short ETFs, which are where 90% of the problems come from.

While the longer the timeframe, the more certain you are to lose in these instruments, there are brief periods where some of them will outperform their index. I believe with the SPXL (3x leveraged SPY) outperformed the S&P500 by 4x or more.

Without this possibility, this volatility decay would be a free lunch. Everyone could short both the long and short ETF and have a risk free investment. Granted there are certain pairings that historically have been more or less a free lunch when shorted together.

It’s worth mentioning that you say the triple short S&P tracker has lost 98% since inception. That’s actually a lot better than if someone had actually been short the market with triple the leverage where they would have lost well in excess of 100%.

Which brings up one benefit of a short ETF. You benefit from the decline, without the risk of unbounded losses. In a 1x short ETF that tracks a non-equity underlying (Oil, gold, etc), you would make more in a strong downward trend than you ever would with an actual short position. The further the decline, the better the comparative performance between the short ETF and an actual short position, as the short position has it’s gains capped, and suffers diminishing returns well before.

One of the more interesting ETFs is UVXY, 2x long VXX. It’s sort of like insurance; profitable for the seller, and puts the buyer at ease while it siphons their money. In just 3 months it’s lost 40% of it’s value, and that’s pretty much the norm. But there’s always that ‘what if’.

Good article…thanks!

Hi Andreas,

Wouldn’t it be possible to short these short ETFs and take advantage of this flaw in their design?

Sure, in theory. I’d be surprised if you’re able to borrow in any meaningful scale though.

Hello Andreas, thanks for your last book Stocks on the Move. Finished reading today and really enjoyed it .

I wonder if the simulations of the book can be done with a group of highly liquid ETFs instead of the S&P 500, so the strategy could benefit from trends in other markets, such commodities, currencies, etc.

I also would like to ask what do you think of the risk or problems (if any) of buying short or leveraged ETFs in a bear market, to avoid the risk of unlimited loss in a short position.

Thanks so much, Alexandre.

ETF strategies are very different. Not necessarily bad, but different. The point with the ranking model from the book is to be able to pick investments from a large universe. For ETFs, we don’t have that problem. The granularity isn’t very high.

Also keep in mind that most ETFs are really, really horrible. There are good ones, mostly the ones that are just mechanically following a stock index. Commodity ETFs are usually very poorly constructed and the short and leveraged ETFs are a really bad idea.

The problems with trying to use short ETFs as a hedge are described above in the article. These instruments are deceptively named and most people buying them don’t understand what they really are.

Hi, Andreas

Always appreciate that you posted professional writings

So, according to your reply above, you don’t recommend the ranking model if trade ETFs?

I know the man, whose name is Kenneth Long, uses the momentum strategy which is a lot similiar with yours. He may deal well with it,,

For the diversified portfolio, do a retail investor have to buy and hold the ETFs, not trade with momentum?

Thanks in advance,

Minjae SEO