As the year is drawing to an end, it’s time to look at what the trend following industry accomplished.

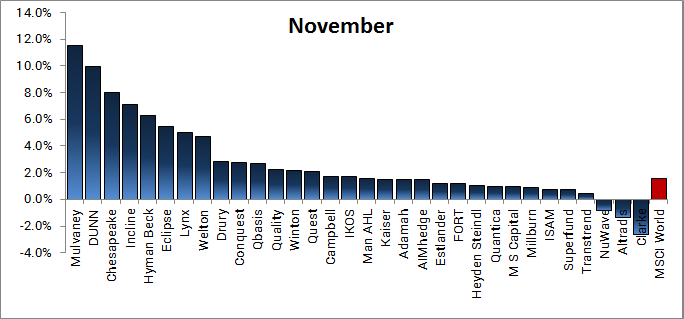

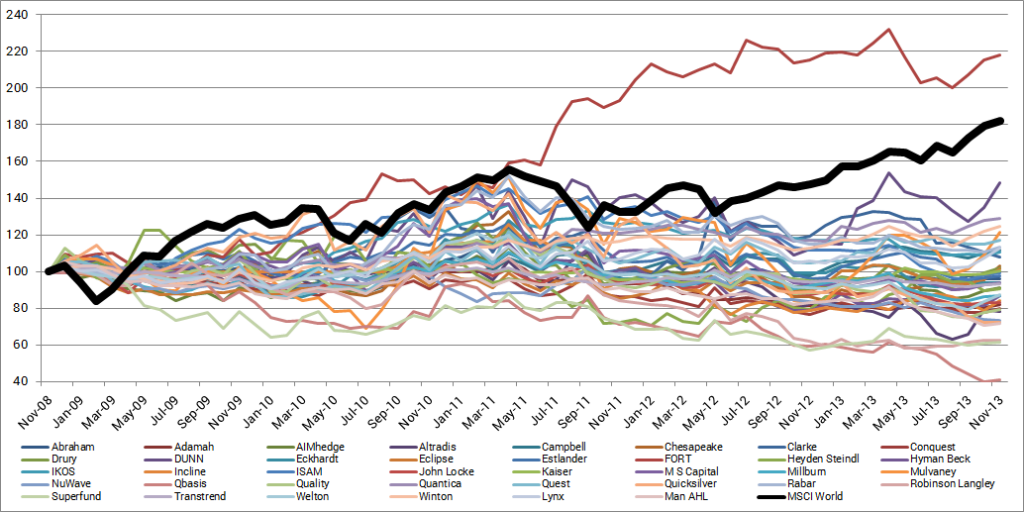

The good news is that the industry has been picking up the past couple of month. Most funds were up in November as trends have picked up, primarily in the equity markets. As the figure below shows, almost all CTA funds were up in November, some by quite large amounts.

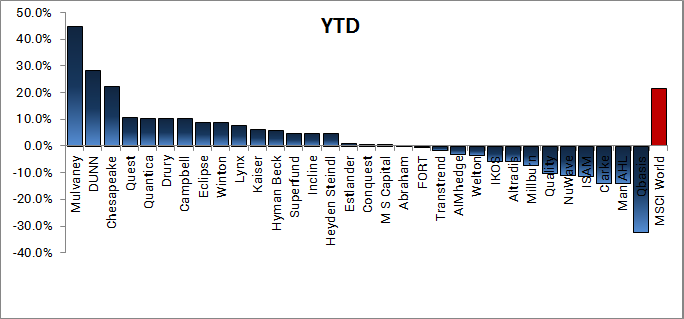

So where does that leave us year to date? Well, even after the past two strong months CTA funds only look ok for the year. Many funds are still in the red.

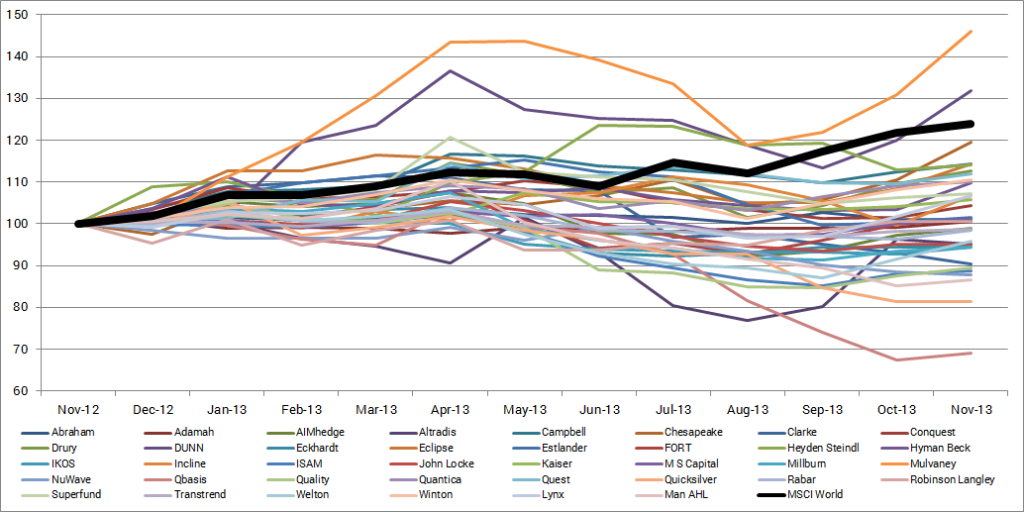

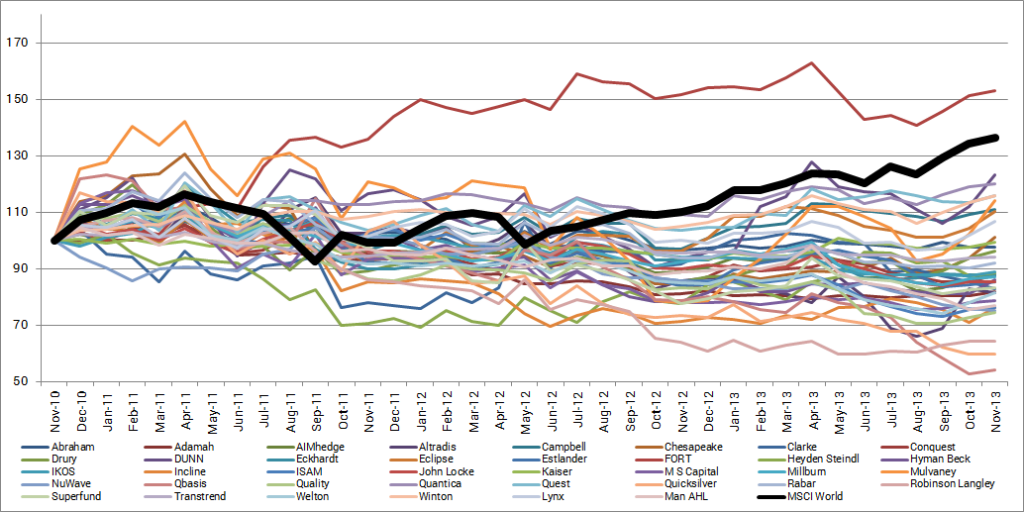

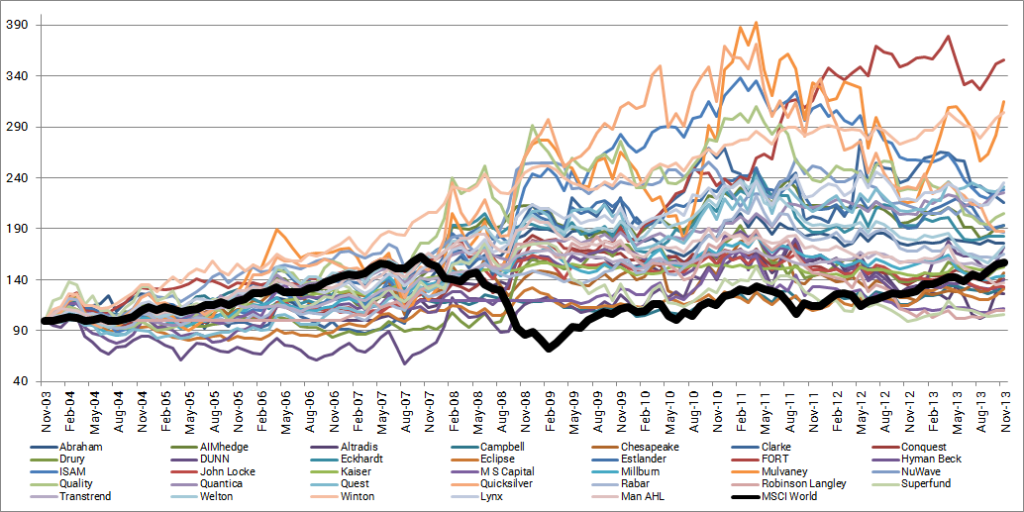

Let’s take a little longer views and get some perspective on this. The following charts show monthly developments for the CTA funds compared to the MSCI World. The latter index is shown as a thick black line. What you’ll see here is probably known to most readers. Over the long run, few strategies have been able to achieve the level of performance we’ve seen in the CTA hedge fund sector. This is not the deepest drawdown we’ve seen in the industry. It is however the longest.

The problem for trend followers the past few years have been the single minded market stories. Whether it has been Greek economic problems or US shutdowns, we’ve seen a few years where the overall market has been looking at a single overwhelming factor at a time. This has created a short sighted risk on / risk off market regime which is horrible for trend followers. As the market focused on a single point, correlations for everything increases. Don’t forget that diversification is the only reason that trend following strategies are worthwhile. When correlations increase, diversification decreases.

Have we seen the end of the problem period for trend followers? Impossible to say. We don’t make predictions. We just follow the markets.

What is clear though is that we all have to adapt. From a trend follower’s point of view, the markets were very easy for several decades. There were good and bad years, but recoveries were quick and the money was fairly easy. The yield levels and directions had of course a lot to do with that. High yields, constantly moving slowly down, created an ideal environment for trend following futures traders.

Standard trend models are not aware of the near zero yield environment and how that changes the game. This is one of many reasons why it makes sense to look closer at trading models and analyze how they will handle this and other potential game changers. Over enough time, the standard trend models will likely keep outperforming. But if they are not adapted, it may be at the cost of high volatility and sharp drawdowns in the meanwhile.

Following the Trend

Following the Trend

Andreas, I don’t see the article.

where is the article?

Sorry, everyone. A database error messed up the article. Should be fixed now.

Andreas,

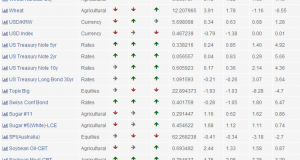

Thank you for this post – very interesting. Would you have the information in the graphs in tabular form? It is hard to distinguish with so many lines.

Rgds

Leonardo

Yep, you’re right, Leonardo. I’m off for Christmas holiday, but I’ll add a table when I get back. I’ll also start posting more often on this site again.