Zipline in Docker This article is contributed by Henrik Nilsson, a clever Swedish guy who read my book and rightly pointed out that I should have mentioned something about how Docker can help simplify the process of setting up and running Zipline. I very much recommend reading and following the instructions below. Having had limited experience with Docker myself, I ...

Read More »Complex Backtesting in Python – Part II – Zipline Data Bundles

Please Login to view this content. (Not a member? Join Today!)

Read More »How to Become a Professional Trader

Would you like to trade for a living? Of course you do. That’s why you are here, reading this article. Professional trading is the subject of much lore and myths, and it can be difficult sometimes to tell reality from fiction. Before you read this article, you need to make a decision. Do you want to become a professional trader? ...

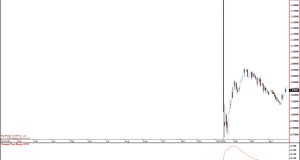

Read More »Don’t get burned – Limiting position sizes based on historical volatility

Please Login to view this content. (Not a member? Join Today!)

Read More »Making Your Own Quant Reporting Engine

Please Login to view this content. (Not a member? Join Today!)

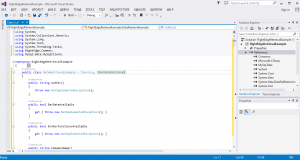

Read More »Making a RightEdge Data Adapter

Please Login to view this content. (Not a member? Join Today!)

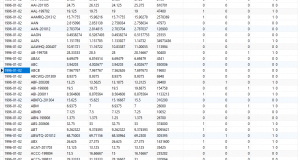

Read More »Setting up your own quant environment – Populating the database

Please Login to view this content. (Not a member? Join Today!)

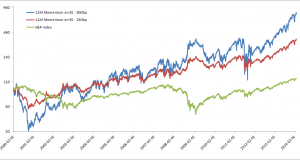

Read More »Twelve Months Momentum Trading Rules – Part 2

Earlier this week I published a simple 12 month momentum model which shows surprisingly good performance. The rules used are so simple that many of you are probably doubting the results. Perhaps you want a closer demonstration? Let’s take a look at the details of this model and see if it really works. First, let’s revisit the rules. Every Friday ...

Read More »Leverage Schmeverage!

Is it risky to be 150% leveraged? How about 1500%? It’s the wrong question to ask. Leverage and risk are not necessarily connected. A common argument against trend following hedge funds is that they are too leveraged. This is based on a lack of understanding of leverage. Most people who bring up this argument are just used to one asset ...

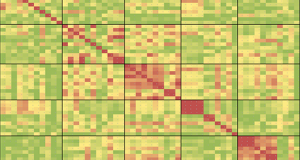

Read More »How to Build Correlation Matrices

They key to trend following is to be very diversified, so that your return curve moves up in a reasonably smooth manner. What you need to ask yourself however is whether you are holding a real diversified portfolio or just a very expensive illusion of safety. Everyone talks of increasing correlations the new risk on/risk off world, but few topics ...

Read More » Following the Trend

Following the Trend