I tend to be a little skeptical when I see books aimed at retail traders with low amount of trading capital, focusing on leveraged trading on FX, CFDs and the like. The very mention of retail forex trading means that there’s a near certainty that whatever comes next is misinformed at best and a scam at worst. But seeing my ...

Read More »Separating Positions from Allocations

Most trading models I see are missing an important concept. It’s not a terribly difficult concept, but it is an important one. It’s not at all strange that most traders, in particular on the retail side, are missing this point. Most trading books skip over it. Most books gloss over it, or just don’t mention it at all. My books ...

Read More »Sophisticated Allocation

Please Login to view this content. (Not a member? Join Today!)

Read More »Don’t get burned – Limiting position sizes based on historical volatility

Please Login to view this content. (Not a member? Join Today!)

Read More »Why managing your own money is a bad trade

A great trader who decides to manage just his own money made a poor trading decision. If you trade anyhow it’s irrational not to manage other people’s money. Living the dream Ok, let’s back up a few steps. Let’s assume that you’ve been trading for a while and you’re getting comfortable doing it. Perhaps you’re becoming pretty good or even ...

Read More »Are you trading or gambling?

Do you want to be a gambler or a professional trader? I’m guessing most people who read this would prefer the latter. But are you sure that you’re not a closet gambler? I used to read a lot of trading books. Back in the early 90’s I started the habit of reading large volumes of trading books. I read everything. ...

Read More »Is your risk random?

Your trading model might have a random risk element and you might not even be aware of it. In particular longer term models need special care to avoid ending up with random risk. The world doesn’t stop spinning when you open a position. The assumptions you used when opening your position may not be valid a week later. Even less so ...

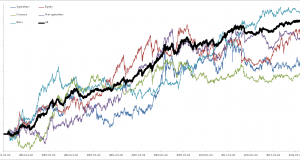

Read More »A study in diversification

Diversification can be a funny thing. It’s one of those things that sound so boring and mainstream that many people simply ignore them. Just something boring that the establishment wants us to do but really has no actual use. Kind of like taxes and seat belts. But diversification can actually be of use. It’s especially important for trend following strategies ...

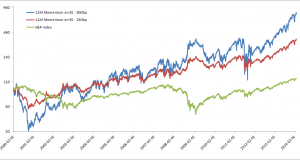

Read More »Twelve Months Momentum Trading Rules – Part 2

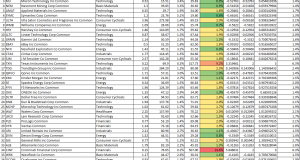

Earlier this week I published a simple 12 month momentum model which shows surprisingly good performance. The rules used are so simple that many of you are probably doubting the results. Perhaps you want a closer demonstration? Let’s take a look at the details of this model and see if it really works. First, let’s revisit the rules. Every Friday ...

Read More »After a strong finish of 2013, trend followers gets a hit in January

Last year saw a return to profitability for most trend following hedge funds. As I wrote a few weeks ago, the equity rally last year provided an excellent environment for long term trend followers. Those funds that are more geared towards equity markets did well and those with very long term horizon did the best. This also explains why the ...

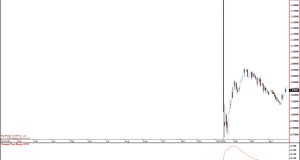

Read More »Trend Followers Hit New Lows

Is trend following dead in the water? Has the concept stopped working? Are we seeing the death of the CTA industry and a return to traditional investments? Fair questions. Let’s look closer before answering them. The industry is certainly going through a very tough period. This is the second bad year in a row and the cumulative drawdowns are adding ...

Read More »Leverage Schmeverage!

Is it risky to be 150% leveraged? How about 1500%? It’s the wrong question to ask. Leverage and risk are not necessarily connected. A common argument against trend following hedge funds is that they are too leveraged. This is based on a lack of understanding of leverage. Most people who bring up this argument are just used to one asset ...

Read More » Following the Trend

Following the Trend