Regardless of your trading style, it is important that you analyse the same thing that you trade. That might sound obvious, but it is a very common error even among professionals. There are two main mistakes in this regard. To analyze the cash markets while trading the futures and to analyze a non-adjusted futures continuation. Both usually have large error ...

Read More »Articles

New: Trend following hedge fund rankings

The trend following hedge funds have done really well in the past few decades. But how did they do last month? And which one did better than the others lately? After I post about the industry, I usually get quite a lot of questions on the funds after. The requests are usually about table format data or better charts. So ...

Read More »Why leverage is pointless

Traders and investors often use leverage as a crude risk measure. It’s an easy way to relate to how much you’re risking. If you have a portfolio worth $100,000 and you borrow to buy $150,000 worth of IBM, you’ve 1.5 times leverage. As simple and intuitive that this approach is, it’s also dangerous and can lead to flawed investment decisions. ...

Read More »ETFs are not what you think they are

The idea of exchange traded funds (ETF) is great. It made perfect sense to create them and they did a great service to the general public. Yet, as financial products often do, they have mutated into veritable financial landmines. When you look to invest in ETFs, be careful. Be very careful. What’s good about ETFs Almost all mutual funds consistently ...

Read More »Leverage Schmeverage!

Is it risky to be 150% leveraged? How about 1500%? It’s the wrong question to ask. Leverage and risk are not necessarily connected. A common argument against trend following hedge funds is that they are too leveraged. This is based on a lack of understanding of leverage. Most people who bring up this argument are just used to one asset ...

Read More »How to Rob Commodity Investors

The Setup Equities live forever. It’s a close enough approximation at least. Futures on the other hand have a very short life span. This creates some unique problems. And some even more unique opportunities. Each futures contract has a predefined date of death. Expiry date as the industry euphemism goes. The 2012 September EuroStoxx contract expires on September 21 and ceases to ...

Read More »How to Build Correlation Matrices

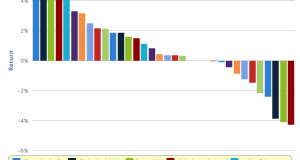

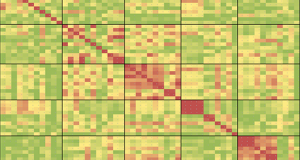

They key to trend following is to be very diversified, so that your return curve moves up in a reasonably smooth manner. What you need to ask yourself however is whether you are holding a real diversified portfolio or just a very expensive illusion of safety. Everyone talks of increasing correlations the new risk on/risk off world, but few topics ...

Read More »Interactive Futures Chart

When you deal with futures trend following it is imperative that you have properly adjusted time series to analyze or you will not get any meaningful results. Our new interactive futures charts are of course fully adjusted and covering all asset classes and all major instruments. Did you ever want to analyze the long term performance of live cattle? How ...

Read More » Following the Trend

Following the Trend