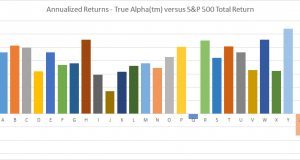

Beating the index isn’t really all that hard. I’m going to show you a great way to beat the market while having some fun in the process. This is a brand new way of managing portfolios, and I’m going to explain every detail of it. The True Alpha method is easy to trade and is unique in offering personalized vanity ...

Read More »A Random Ass Kicking of Wall Street

A random number generator can beat your mutual fund. Given a choice between a random portfolio and a mutual fund, I’ll go with the randomizer every day of the week and twice on Sundays. You think I’m joking? I’m not joking. Trashing the mutual fund industry is almost like beating a dead horse. Except of course that it’s a thriving, ...

Read More »The Stock Investing Illusion

Most people trade stocks because it seems easy. We all know what companies do and how they stock work. At least, that’s what most people would think. It’s a dangerous and deceptive illusion. Equities seem attractive for two reasons. First because they appear simple, and second because of the common belief that stocks always appreciate over time. Both of these points ...

Read More »Stocks on the Move is Out!

A year ago I wrote an article about why trend following doesn’t work on stocks. That article surprised many people. After all, I was mostly known for writing a book about trend following on futures. Why would I diss trend following? And why does a futures guy talk about stocks? The fact is that I’ve been working with stocks longer ...

Read More »Why I am Self Publishing my New Trading Book

I’m one of the top 5% best selling trading book authors in the world. My first book was a run-away success. And yet I’m about to self publish my next work. Why would an established author want to self publish? There is an unjustified perception that self publishing means poor quality. Let me tell you why that’s not necessarily true. Publishing ...

Read More »Mutually Assured Destruction

Almost all mutual funds in the world fail to do their job. You’ll find better odds at the racing track than you will buying mutual funds. So why do people still buy them? Almost everyone in the developed world has a stake in a mutual fund. Even if you didn’t actively buy into any mutual fund, your pension fund is ...

Read More »Beating the Index with Minimum Rules

Do you want to beat the index with just a few lines of code? You don’t even need to program it. It’s simple enough to do manually. Beating the index is probably not the right term though. Killing it might be a better word. Beating the index is supposed to be very difficult. After all, around 80-90 percent of all ...

Read More »After a strong finish of 2013, trend followers gets a hit in January

Last year saw a return to profitability for most trend following hedge funds. As I wrote a few weeks ago, the equity rally last year provided an excellent environment for long term trend followers. Those funds that are more geared towards equity markets did well and those with very long term horizon did the best. This also explains why the ...

Read More » Following the Trend

Following the Trend