Most trading models I see are missing an important concept. It’s not a terribly difficult concept, but it is an important one. It’s not at all strange that most traders, in particular on the retail side, are missing this point. Most trading books skip over it. Most books gloss over it, or just don’t mention it at all. My books ...

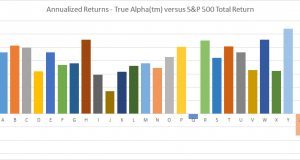

Read More »True Alpha – How the CLENOW portfolio makes a fool out of the S&P 500

Beating the index isn’t really all that hard. I’m going to show you a great way to beat the market while having some fun in the process. This is a brand new way of managing portfolios, and I’m going to explain every detail of it. The True Alpha method is easy to trade and is unique in offering personalized vanity ...

Read More »How to make proper equity simulations on a budget – Part 2 Software

Your choice of simulation software can have a greater impact than you may think. Most simulation platforms that are priced within reach for hobby traders and even smaller asset managers are quite frankly junk. If you start modeling in those environments, you will most likely either need to throw it all out and start over later, or accept massive error factors. ...

Read More »A Random Ass Kicking of Wall Street

A random number generator can beat your mutual fund. Given a choice between a random portfolio and a mutual fund, I’ll go with the randomizer every day of the week and twice on Sundays. You think I’m joking? I’m not joking. Trashing the mutual fund industry is almost like beating a dead horse. Except of course that it’s a thriving, ...

Read More »The Stock Investing Illusion

Most people trade stocks because it seems easy. We all know what companies do and how they stock work. At least, that’s what most people would think. It’s a dangerous and deceptive illusion. Equities seem attractive for two reasons. First because they appear simple, and second because of the common belief that stocks always appreciate over time. Both of these points ...

Read More »Is your risk random?

Your trading model might have a random risk element and you might not even be aware of it. In particular longer term models need special care to avoid ending up with random risk. The world doesn’t stop spinning when you open a position. The assumptions you used when opening your position may not be valid a week later. Even less so ...

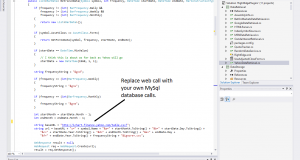

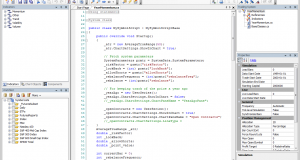

Read More »How to build a professional simulation environment – On the cheap

Do you want to learn how to build a professional environment for trading simulations without paying an arm and a leg? Building a proper environment for developing and testing trading strategies can be very expensive. It doesn’t have to be though, as long as you’re willing to put in some work. I work with both cheap and expensive tools and ...

Read More »Beating the Index with Minimum Rules

Do you want to beat the index with just a few lines of code? You don’t even need to program it. It’s simple enough to do manually. Beating the index is probably not the right term though. Killing it might be a better word. Beating the index is supposed to be very difficult. After all, around 80-90 percent of all ...

Read More » Following the Trend

Following the Trend