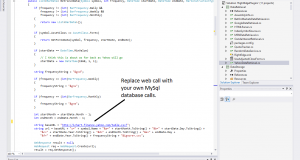

In the past year, that is by far the most common question I get. Now that Quantopian went the way of the Dodo, is Zipline dead? Should we switch to a different backtesting engine? The short answer is that the rumors of Zipline’s demise are exaggerated, but let’s take it from the start. My 2019 book Trading Evolved focuses on ...

Read More »Complex Backtesting in Python – Part II – Zipline Data Bundles

Please Login to view this content. (Not a member? Join Today!)

Read More »Complex Backtesting in Python – Part 1

Please Login to view this content. (Not a member? Join Today!)

Read More »Separating Positions from Allocations

Most trading models I see are missing an important concept. It’s not a terribly difficult concept, but it is an important one. It’s not at all strange that most traders, in particular on the retail side, are missing this point. Most trading books skip over it. Most books gloss over it, or just don’t mention it at all. My books ...

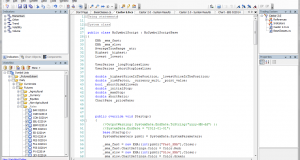

Read More »Making Your Own Quant Reporting Engine

Please Login to view this content. (Not a member? Join Today!)

Read More »How to make proper equity simulations on a budget – Part 2 Software

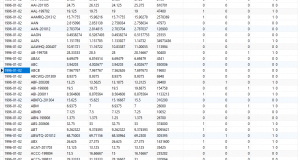

Your choice of simulation software can have a greater impact than you may think. Most simulation platforms that are priced within reach for hobby traders and even smaller asset managers are quite frankly junk. If you start modeling in those environments, you will most likely either need to throw it all out and start over later, or accept massive error factors. ...

Read More »Why I prefer RightEdge for strategy modeling

Choosing a good platform for strategy modeling, simulations and signal generation is critical. The bleak reality is that most back testing software is horribly bad. They are geared towards consumers with limited knowledge and experience and they cater to what your average get-rich-quick technical analysis guru claims that you need. I’m often asked for my views on simulation platforms, and in ...

Read More »Leverage Schmeverage!

Is it risky to be 150% leveraged? How about 1500%? It’s the wrong question to ask. Leverage and risk are not necessarily connected. A common argument against trend following hedge funds is that they are too leveraged. This is based on a lack of understanding of leverage. Most people who bring up this argument are just used to one asset ...

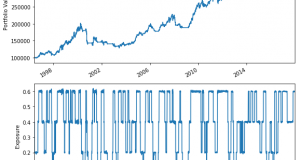

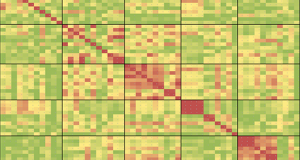

Read More »How to Build Correlation Matrices

They key to trend following is to be very diversified, so that your return curve moves up in a reasonably smooth manner. What you need to ask yourself however is whether you are holding a real diversified portfolio or just a very expensive illusion of safety. Everyone talks of increasing correlations the new risk on/risk off world, but few topics ...

Read More » Following the Trend

Following the Trend