Yes, I confess. I wrote that title to mess with search engines. As it turns out, the most popular page on this site, by far, is this one. It’s particularly curious for me, since I keep making the point that trading system rules are overrated. I’ve never come across anyone selling trading rules who actually knows anything about trading. And ...

Read More »Author Archives: Andreas Clenow

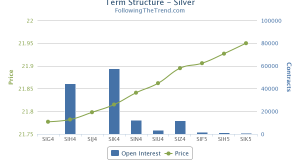

Term Structure – The forgotten piece of the puzzle

Last week I wrote about the dangers of analyzing the wrong time series. This is still a very common mistake made by traders and analysts and I cannot stress enough just how important it is to get your data right. It’s not a matter of opinion. Just math. Simple continuations without basis gap adjustments are just plain wrong and so ...

Read More »Don’t analyze the wrong time series

Regardless of your trading style, it is important that you analyse the same thing that you trade. That might sound obvious, but it is a very common error even among professionals. There are two main mistakes in this regard. To analyze the cash markets while trading the futures and to analyze a non-adjusted futures continuation. Both usually have large error ...

Read More »Global trends overview – Updated daily!

How many markets do you follow? Are you aware of the ongoing trends across all asset classes? It’s difficult to keep up with the trends and easy to forget some markets. Perhaps you haven’t been looking at the soybeans in a few months, and you completely missed out on a massive rally. There’s a new page in place on this ...

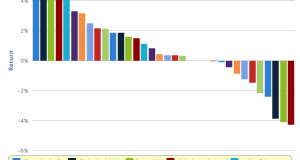

Read More »After a strong finish of 2013, trend followers gets a hit in January

Last year saw a return to profitability for most trend following hedge funds. As I wrote a few weeks ago, the equity rally last year provided an excellent environment for long term trend followers. Those funds that are more geared towards equity markets did well and those with very long term horizon did the best. This also explains why the ...

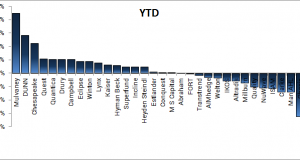

Read More »New: Trend following hedge fund rankings

The trend following hedge funds have done really well in the past few decades. But how did they do last month? And which one did better than the others lately? After I post about the industry, I usually get quite a lot of questions on the funds after. The requests are usually about table format data or better charts. So ...

Read More »Why leverage is pointless

Traders and investors often use leverage as a crude risk measure. It’s an easy way to relate to how much you’re risking. If you have a portfolio worth $100,000 and you borrow to buy $150,000 worth of IBM, you’ve 1.5 times leverage. As simple and intuitive that this approach is, it’s also dangerous and can lead to flawed investment decisions. ...

Read More »ETFs are not what you think they are

The idea of exchange traded funds (ETF) is great. It made perfect sense to create them and they did a great service to the general public. Yet, as financial products often do, they have mutated into veritable financial landmines. When you look to invest in ETFs, be careful. Be very careful. What’s good about ETFs Almost all mutual funds consistently ...

Read More »Trend followers strike back – 2013 results

Most investment strategies have good years and bad years. Sometimes a couple of bad years come along for a type of strategy, and everyone predicts the death of that strategy. As it turns out, the best time to enter into a strategy tends to be just when it’s having a bad run. This was shown very clearly in Jack Schwager’s ...

Read More »Apologies for site error. Fixed now.

Just as I sent out the article on the 2013 trends, my database seems to have gotten a little upset. Some odd table corruption problem caused the article text, along with all other articles, to disappear. I had a stern talk with the database and we seem to get along again. Sorry for the confusion. The article from yesterday works ...

Read More »State of Trends, December 2013

As the year is drawing to an end, it’s time to look at what the trend following industry accomplished. The good news is that the industry has been picking up the past couple of month. Most funds were up in November as trends have picked up, primarily in the equity markets. As the figure below shows, almost all CTA funds ...

Read More »May Trend Following Performance

Let me start by apologizing for the absence of posts for a while. My ‘day job’ of running our asset management shop has taken precedence in this turbulent times, along with my hobby project TradersPlace.net. Next week, on Wednesday the 26th of June, I’ll be in London speaking at the Battle of the Quants. Hope to see you there. Ok, ...

Read More »Trend Followers Moderately Up in March

March was in most regards a slow month. Only one sector showed persistent trends and this was the normally troublesome equities market. The key trend was of course still the whole Japan complex, fueled by a decisive central bank. Most trend followers have been long the Nikkei, short the JY, long the RY and probably a few more similar related ...

Read More »Updating ‘Following the Trend’ Core Strategy for 2012

I was recently questioned about how the strategy I present in Following the Trend did in 2012. Those who read it may recall that the analysis ends as of December 2011. It should come as no surprise that last year was bad. 2012 spelled trouble for most trend followers and most CTA hedge funds set new all time max draw ...

Read More »Strong January Performance for Trend Followers

January was a very strong month for trend followers. Almost all funds are now far off their lows. Is this the big turn? Have we started the ascent to new highs? Perhaps. But don’t forget that in this business, we’re not attempting to forecast the future. We just follow a statistically sound method. We tilt the probabilities slightly in our ...

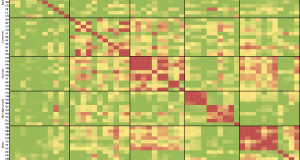

Read More »Market Decoupling a Positive Sign

Trends are starting to come back into play. What we’ve seen the past few months has been a slow turnaround in the managed futures performance across most funds. The problem in the past years has been the single-mindedness of the markets. At any given time, a single overwhelming worry has been driving the markets. The reason it self has varied. Sometimes everything ...

Read More »Mebane Faber on Following the Trend

Mebane Faber is the founder and CEO of Cambria Investment Management, author of best selling book The Ivy Portfolio, a highly respected financial blogger, an acclaimed public speaker and according to unconfirmed sources a decent surfer. Meb has been kind enough to read through my book and here is what he had to say about it. “A lot of ...

Read More »Number One

Thank you for reading my new book! Today it just hit the number one best seller on Amazon in the Futures category. Thank you all for the great feedback I got so far. Especially Craig who found the table error and Alison who pointed out the spelling error in the second row of the preface. Both errors have been corrected ...

Read More »Available on Amazon.com from Today

The hard cover version of Following the Trend is available from today on Amazon.com. The Kindle has been available for download for a couple of days and is currently the number 3 best seller in the category Futures on Amazon. What does it mean to be number three in this category? I have absolutely no idea. If you haven’t done ...

Read More »Legendary Turtle Trader on Following the Trend

In the beginning of the 1980’s two of the most successful and more admired traders in the business were caught in a friendly argument. The discussion was regarding trading skills. One claimed you need to be born with the right skills. The other claimed that this can be taught. It was a classic nature vs. nurture argument. They were unable ...

Read More » Following the Trend

Following the Trend