Almost all mutual funds in the world fail to do their job. You’ll find better odds at the racing track than you will buying mutual funds. So why do people still buy them? Almost everyone in the developed world has a stake in a mutual fund. Even if you didn’t actively buy into any mutual fund, your pension fund is ...

Read More »Author Archives: Andreas Clenow

The Short Victory of 2014

Please Login to view this content. (Not a member? Join Today!)

Read More »Why managing your own money is a bad trade

A great trader who decides to manage just his own money made a poor trading decision. If you trade anyhow it’s irrational not to manage other people’s money. Living the dream Ok, let’s back up a few steps. Let’s assume that you’ve been trading for a while and you’re getting comfortable doing it. Perhaps you’re becoming pretty good or even ...

Read More »Trading the Shorts

Please Login to view this content. (Not a member? Join Today!)

Read More »Normalizing Term Structure

Please Login to view this content. (Not a member? Join Today!)

Read More »Why I’m not renewing my MTA membership

I’m a member of the Market Technicians Association (MTA) and a holder of their Chartered Market Technician (CMT) certification. But not for long. I had a good reason for joining and I have an even better reason for leaving. What I actually lack a good explanation for is why I remained a member for so long time. The MTA is ...

Read More »Rebalancing Act

Please Login to view this content. (Not a member? Join Today!)

Read More »Are you trading or gambling?

Do you want to be a gambler or a professional trader? I’m guessing most people who read this would prefer the latter. But are you sure that you’re not a closet gambler? I used to read a lot of trading books. Back in the early 90’s I started the habit of reading large volumes of trading books. I read everything. ...

Read More »Is your risk random?

Your trading model might have a random risk element and you might not even be aware of it. In particular longer term models need special care to avoid ending up with random risk. The world doesn’t stop spinning when you open a position. The assumptions you used when opening your position may not be valid a week later. Even less so ...

Read More »Plunge Entry Models

Please Login to view this content. (Not a member? Join Today!)

Read More »A Counter Trend Indicator: Profit from Trend Followers’ Weakness

A good indicator is based on sound logic. It should try to quantify or visualize a concept that makes sense and is easily explainable. Mostly I use very simple indicators. The most basic of indicators can be very helpful if used rightly. The indicator I’m about to describe here is quite simple in concept but requires a few more steps ...

Read More »A Counter Trend Concept

Please Login to view this content. (Not a member? Join Today!)

Read More »Why technical analysis is shunned by professionals

The poor reputation of technical analysis is well deserved. It’s their own fault really. The way this field has expanded makes it very difficult to take it seriously. It’s been reduced to a slogan used by scam artists to sell nonsense books, trading systems, newsletters and ‘mentoring’ based on quasi religious numerology and mysticism. Professionals stay clear of the term ...

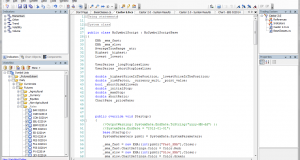

Read More »Why I prefer RightEdge for strategy modeling

Choosing a good platform for strategy modeling, simulations and signal generation is critical. The bleak reality is that most back testing software is horribly bad. They are geared towards consumers with limited knowledge and experience and they cater to what your average get-rich-quick technical analysis guru claims that you need. I’m often asked for my views on simulation platforms, and in ...

Read More »How to build a professional simulation environment – On the cheap

Do you want to learn how to build a professional environment for trading simulations without paying an arm and a leg? Building a proper environment for developing and testing trading strategies can be very expensive. It doesn’t have to be though, as long as you’re willing to put in some work. I work with both cheap and expensive tools and ...

Read More »Trend following does not work on stocks

There’s a good reason why most professionals who apply models similar to trend following to stocks call them momentum models. It’s not just a clever rebranding, it’s really a very different game. To blindly cling to trend following as a religion, disregarding any real world evidence and attacking anyone presenting ideas that differ to the trend following mantra is not ...

Read More »Year Momentum Model

Please Login to view this content. (Not a member? Join Today!)

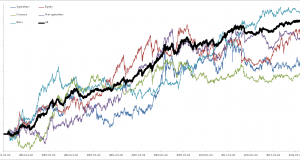

Read More »A study in diversification

Diversification can be a funny thing. It’s one of those things that sound so boring and mainstream that many people simply ignore them. Just something boring that the establishment wants us to do but really has no actual use. Kind of like taxes and seat belts. But diversification can actually be of use. It’s especially important for trend following strategies ...

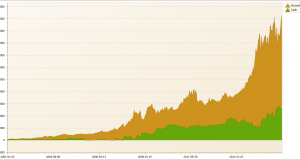

Read More »Beating the Index with Minimum Rules

Do you want to beat the index with just a few lines of code? You don’t even need to program it. It’s simple enough to do manually. Beating the index is probably not the right term though. Killing it might be a better word. Beating the index is supposed to be very difficult. After all, around 80-90 percent of all ...

Read More »Twelve Months Momentum Trading Rules – Part 2

Earlier this week I published a simple 12 month momentum model which shows surprisingly good performance. The rules used are so simple that many of you are probably doubting the results. Perhaps you want a closer demonstration? Let’s take a look at the details of this model and see if it really works. First, let’s revisit the rules. Every Friday ...

Read More » Following the Trend

Following the Trend