Would you like to trade for a living? Of course you do. That’s why you are here, reading this article. Professional trading is the subject of much lore and myths, and it can be difficult sometimes to tell reality from fiction. Before you read this article, you need to make a decision. Do you want to become a professional trader? Or do you want to fantasize about becoming one?

The common fantasy of what professional traders do is very appealing. But it is also far from reality. If you would like to maintain the illusion and stay with the fantasy, this article is not for you. This article is for those who want the real thing.

Still with me?

How Much does a Good Trader Make?

I want you to think of a number. What do you think a good trader should make per year? Not in terms of salary or bonus or something like that. No, rather how many percent per year on average a solid trader should produce.

When speaking at conferences, I often ask the audience this question. It’s very interesting that I will get very different answers depending on if the audience are primarily industry professionals or hobby traders. The latter group tends to suggest 5 to 10 times higher return numbers.

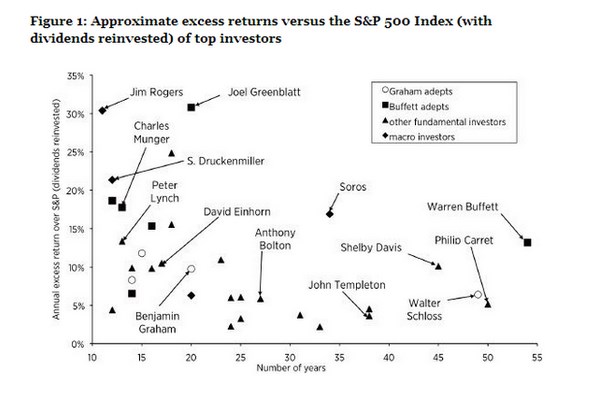

Here’s the most important sentence in this article: The very best traders in the world have achieved annualized return numbers of about 20% p.a.

That doesn’t mean that every year hits such a number of course. Some years could be more, some years less. Some years negative. In any given year, returns of much higher is possible. Those hitting yearly return numbers of 18-23% kind of range over a few decades are the very best in the world. This is what we have come to expect from the likes of Buffett, Soros, Lynch, Einhorn, Jones, Koulajian, Harding etc.

Source: Frederik Vanhaverbeke

So if the number you thought was was 40, 50, 60 or even 100 percent, you should now start worrying. What you need to ask yourself is this. Do you have a real world, rational reason, for assuming that you can do more than double of what the very best in the world can do?

The Math of Impossibility

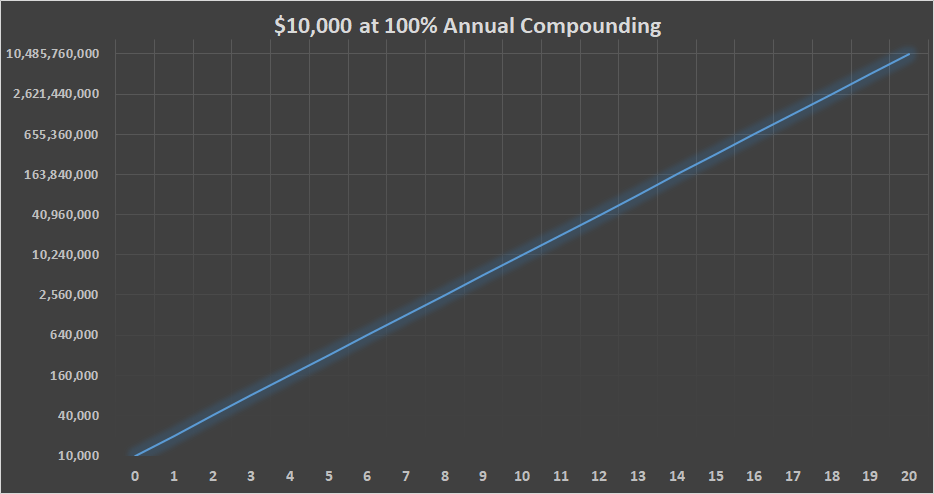

Imagine for a moment that we live in a fantasy world where it is possible to compound at 100% p.a. After all, there is no shortage of bloggers out there who make such claims. Let’s assume that this is actually true, as insane as that might sound.

So we’ll put a small amount of cash into this insane sounding money making machine that some self proclaimed market wizard sells, and start trading. Let’s put up 10k.

In a year, our account is at 20,000 and after two years the account stands at 40,000. Great! Let’s keep the ball rolling. In 7 years, we’ve got a million bucks. But why stop there?

From our first million, there’s only a couple of years to eight digits. By year 10, we have over 10 million cold ones, and of course by year 11 we’ve got 20 million smackaroos.

It’s a little disappointing that we have to wait all the way to year 17 before we see a billion. But clocking the first ten billion in year 20 should call for some champagne.

This makes for a very attractive day dream. Of course, no one has ever done this in history.

Hitting 100% in a single year is possible, through skill, hard work, dumb luck or a combination. But it’s an outlier. No one averages at such numbers.

But what about Mr. XYZ who claims to have turned a tiny amount into a massive amount in no time at all, and is now offering to teach me how to achieve hundreds of percent a year if I pay him?

Well, good luck with that.

Back to Reality

Let’s go back to the real world again. For the sake of this article, I’m going to assume that you have a trading methodology that you’re happy with, and that you are looking at ways to turn this into a living.

You probably spent quite a bit of time already learning trading. You’ve read the books, you did your research, you ran your simulations. Perhaps you even trader for some time, and have strong results to show for it. Great! Now let’s see what options this leaves you.

The way I see it, you have three main routes to consider.

- Get a job in the financial industry.

- Trade your own money, aka day trading.

- Start a business.

Getting a Job

There’s much to be said for getting a good job in the business. There are very few professions where the earning potential is as high as in the financial industry. How many other sectors let 20-something punks pull seven digit bonuses?

It’s not easy getting the kind of job roles that can net you seven figures. Then again, most rational people are happy with mid six digits, and that’s a whole lot easier.

Don’t underestimate the value of a salary. If you work in the financial industry, you will likely earn a decent six figure amount even for a fairly junior position. The safety and stability of a paycheck shouldn’t be underestimated. You will also learn from being inside the business. Even if you eventually want to go out on your own, the insights that be only be gained from working in the business can be of very high value.

The jobs in the financial industry may not be exactly what people outside it think though. Most people with the word trader in their job title do nothing even remotely similar to pop culture perception. Most are execution traders, handling the execution of other people’s orders, and similar.

There are very few people in the business who are simply given a pile of money to trade any way they like. Extremely few. Working in the financial industry can be very rewarding, but for the vast majority it’s just a job like any other.

Will They Steal Your Strategies?

Perhaps you have built some solid trading code, and you’re considering using it to land a high paying job with a financial institution. But you’re worried that they might simply steal your code. How secretive should you be?

This is largely a misconception. They will not be interested in stealing your code. And if they are, they are amateurs you don’t want to deal with anyhow. It’s not even a matter of ethics. It’s completely irrational.

Even if you have built something really great, it’s likely not completely revolutionary. A rational manager would be very impressed if you build something similar to what they’re using, even if it’s less good. Being outside the business, you wouldn’t be expected to have something actually better than whatever they’re already using.

Even if it is better, and even if it is really revolutionary, stealing it makes no sense. If you did something really unique, it makes sense to hire you. Taking your code would mean that they would need to spend time and money reverse engineering and understanding it, adapting it to their needs, instead of simply hiring the guy who built it.

And besides, if you built something great once, chances are you’ll do it again. Of course they’ll want to hire you, and not steal the code.

The concept of super secret code worth massive amounts of money is largely a myth. It doesn’t work like that.

So how do you get a job in the business?

Same way you get to Carnegie Hall, I suppose.

The competition is tough. If you didn’t attend top schools, had top grades and have a solid contact grid in the market, you’ll need to compensate with very hard work. Make yourself visible. Stand out. Get the right people to notice you.

There are no easy answers. It is very tough to get a good job in the business, and you are likely to be rejected many times. Don’t let that stop you.

What about Trading for Myself?

I have written before about my view on how trading your own money is a bad trade. If you make a living off trading your own money, you will be forced to take too high risk, to get enough money out to live on. That in turn will lead to economic downfall.

Almost all day traders end up losing most or all of their money.

If you go this route, the odds are strongly against you. When you hear stories of extremely successful day traders, people trading their own money, making very high returns and building wealth, you can be sure that you’re dealing with one of two scenarios. Either they are extreme statistical outliers or the stories are beaucoup de merde, if you pardon my French.

Daytraders tend to advertise their success, while being very quiet about losses. The article about the trader who made 500% in a year isn’t likely to be updated when he lost everything the following year.

The problem with daytrading comes down to risk.

Assume for a moment that you are all set to start your path as a daytrader. You’ve got your trading strategy, and you’ve done your research well. You have been working hard and saved up 100,000 bucks to start off trading with.

So what kind of returns will you be aiming for? How much money do you need to live on?

I suppose that very much depends on where in the world you live. An entry level finance job here in Zurich would pay you in the low six figures, and that’s probably the case in Manhattan as well. But if you’re happy living somewhere cheaper, you could probably get by with 50k.

With that target, you would need to achieve a 50% return on your 100k. More than double of what Buffett has achieved.

In order to be able to reach such returns, you need to take on a high degree of risk. Return isn’t free. Never was, never will be. Unless your dad is the union representative at Bluestar Airlines. Risk is the currency we all use to buy performance.

Skill and hard work will let you buy a little more performance for a little less risk, but to be able to hit 50% trading returns you will need to take on a very high amount of risk.

It is a very reasonable assumption that your worst drawdown will be somewhere between two to three times your long term annual return. That is what most experience at some point. Remember that the only people who never have losses are the liars.

Aiming for a 50% average yearly return will end up in wiping out your entire account, sooner or later. It is the equivalent of betting all your money on red on the roulette table. You might get lucky a couple of times, but if you stay at the table you will lose everything sooner or later.

Trading for a living means living off your returns. That implies taking out the gains to pay for basic needs, such as rent, food, alimony and cocaine, depending on your personal situation. There are two main implications of this.

First, withdrawing gains for living expenses means that you will not be compounding the returns. This will make a substantial difference in the long run.

Second, reliance on gains to cover living expenses will absolutely push you to take on too high risk, aiming for too high returns. Daytraders rarely have realistic aims, but are rather aiming for 50-100% p.a. This is sure to lead to disaster in the long run.

To be clear, the main reason why daytraders fail is not a lack of trading skill. The issue is that they take on such high risk, that trading skill becomes irrelevant.

The Good News

The bad news is that realistic long term results are in the 10-15% range. But the good news is that returns in this range can make you quite wealthy.

The money in this business is not in high return numbers. Never was. That’s an illusion, marketed to hobby traders. The best in the business have become billionaires by achieving around 20% p.a. You can become a millionaire in this field by achieving 10-15%.

Trading Other People’s Money

The truth is that the interesting money in this business is in managing other people’s money. There is a great demand for such services and it can be a very rewarding field to be in.

When you manage other people’s money, you naturally get paid for this. The base fee you get, usually referred to as a management fee, provides a steady income. Do not underestimate the value that this provides.

Having a base income will allow you to make rational decisions, and not chase unrealistic results. It will allow you to aim for realistic returns, without risking disaster.

Now you can trade your own money, along with clients’, and make money for everyone.

A common misunderstanding is that clients, or potential clients, will invest with managers who have the highest return. Too high return targets are a major warning sign for sophisticated investors.

If someone claims to achieve 50% yearly return with Sharpe ratio of 10, nobody will take them seriously. That’s like some guy claiming to run 100 meter dash on two seconds. Extraordinary claims require extraordinary proof. And no one has ever managed that so far.

No, what you will find is that informed investors will pay more attention if you target 15% p.a. with a Sharpe of 0.8, for example. Responsible, long term, realistic asset management.

You can still trade your own money of course. But by managing other people’s assets as well, you stability and can make a good living off trading without the irrational risks of daytrading.

Comparing the Approaches

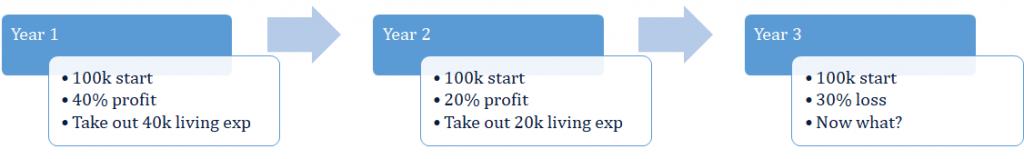

So let’s assume you’ve got 100k to trade, and a solid trading strategy. Now you want to go and be a daytrader.

Since you plan on living off the returns, you would need to aim for very high returns. Here’s a very likely scenario for what may follow.

Year 1, you start off really well. In this example, shown in the image below, you get a 40% realized return the first year. That’s an amazing return. Far above reasonable, long term average. Good job, buddy!

Now you take out the return, 40k, and pay off your bookie and get the repo man off your back.

Next year, we start again with 100k, and make a 20% net return. Still a very good year. But is 20k enough to live on? Well, at least we made a gain.

Then comes the inevitable. Sooner or later, there will be a losing year. Year 3, we start off with the 100k again, and make a 30% loss. That’s not even a big loss in the context of the previous gains. This doesn’t mean that there is anything wrong with your trading strategy.

But, now your initial 100k is down to 70. You have less money than when you started three years ago, and you didn’t get a cent for yourself this year. You can’t pay your rent, your five hungry kids are screaming for food and a career in telemarketing looks better and better.

This is a career killing year. It might happen year 3, or year 1 or year 7. But it will happen.

Now look at the alternative.

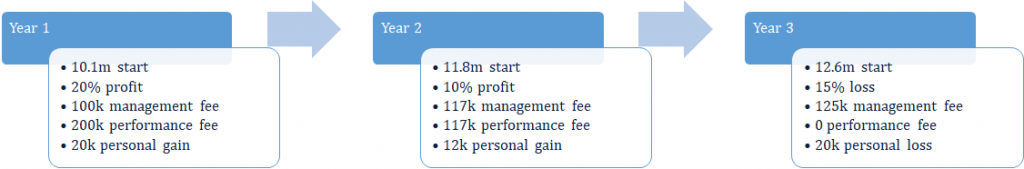

Start over on these three years. This time around, we raise some external assets, and manage other people’s money along with our own. Let’s go out there and find 10 million. How do we raise ten mil? Given the current word count on this article, that might become a subject of the next article…

For managing the external assets, we’re going to charge a fairly reasonable 1+10. That is, 1% management fee and 10% performance fee. And since we now have a base income, we can afford to trade a little more responsibly. Let’s cut the volatility in half. We’re going to take on half the risk, for half the return.

In year 1, we start off with 10.1 million. The external 10, plus our own 100k. With half the risk, we’ll end up with a return of 20%. You think a 20% is ridiculously low? Think again. It’s much higher than industry average, and any rational client will be very happy.

Instead of making a mere 40k, as we did daytrading this year on high risk, we now make a lot more. We’re clocking 100k management fee, 200k performance fee and 20k personal gain. That should cover your bad habits.

In the second year, we start off with 11.8 million, since there was no need to withdraw money. Your client is likely very happy and staying with you, and you got paid without having to take out your own money. At half risk, we’re making 10% this year. Still a good result, and both you and your client are making good money.

But what about the career killing year 3?

Now you start off year 3 with 12.6 million, having compounded the returns. By the same logic, you’re now seeing a 15% loss. That’s not a fun year, but certainly not a career killer. After +20 and +10, a -15 year is very much in proportion and reasonable. If you have properly explained your strategy and potential gains and losses to your client, he’ll stay with you. And you still made 125k management fee, minus the 20k personal loss.

You can now live to fight another day. Perhaps year 4 will be another +20% year. You and your client still made money over time, and there’s no need to polish up your CV.

Step by Step

The first step towards becoming a professional trader is to understand how the business works. Learn to see past the usual platitudes of hobby trading lore and understand where the real money is made, and lost.

There are more steps to be overcome of course. Another extremely important point, which deserves an article by itself, is to understand risk. What the word means in a financial context, and how it is misunderstood by practically all trading books.

Then there is the point on how to approach methodology and model origination. And once all of this is done, you need to learn about how to approach asset raising, how to present yourself and your strategy, and how to market your investment services. More articles will come on these topics.

Make no mistake, this is a business like any other. A very interesting and highly rewarding one, but it is still a business and that is the way it should be approached.

Lower returns and responsible asset management may not sound as sexy as extreme leverage forex daytrading and similar get-rich-quick schemes. But one is real and the other is not.

So the question is if you want to be a trader, or daydream about becoming one. Your call.

Following the Trend

Following the Trend

Hi Andreas

Thank you for the article.

From what I read on different websites from people in the market managing business:

“This is just my opinion, and others like Heech are proving that it can be done, but I don’t see running a pooled fund with less than $20MM as a viable option. It can be done if performance is >30% annual, but a solid business plan should be based on something a bit more easily attained. Something like 10% CAGR is more reasonable. So, at $10MM AUM and a 2/20 you’d have gross revenue of about $400K.

$400K is just enough to keep things running with a solid personal income, but not worth the headaches unless you are going to try to grow it. Growing at a more rapid rate means hiring out aspects of the business, which means higher costs.

Sure, you might hit 40% ROR your first year, and that would be great. But you can’t write a business plan around that expectation. At $20MM AUM, the management fees alone are enough to keep things running smoothly, as well as providing a good fundraising budget. But with less than $10MM, you are really vulnerable. Literally, one bad quarter might put you under.

Otoh, running it as SMAs would be cheaper and simpler. Compliance, accounting, and administration are all easier and far less costly. Setup is a breeze. As far as track record, if the program is the same, the performance carries over when you decide to create the pooled fund. You’d setup the Advisor’s master account (usually an LLC) at the broker, and then a linked account for the LP that would be the only client of the Advisor. It could be an LLC too, but that is for you to decide.

Anyway, you’d run the program in the LP account, and any testing in your own personal account. Never conduct testing in the LP account as any managed account performance must be reported, but prop trading in personal accounts doesn’t. You could just run it like this at minimal cost until you were ready to bring on clients.

As soon as you bring on clients, you need to full setup. In your case, you are already holding yourself out to the public as an adviser, so typical exemptions don’t apply to you. If they aren’t family, you’re probably gonna need to register. “

If someone cannot raise 10 million for starting a fund, then it is game over? Do you have some cheaper methods of managing other people’s money?

….and another advice from industry insider:

“I’ll save you alot of time and trouble and tell you.. Don’t Bother. Hundreds of succesful traders have gone this route and nearly everyone has failed, not because they did not perform, but because starting a fund with such small AUM will never amount to anything. Funds now charge 1% + 15-20% performance. Traders find that managing less than few million you’re really making a plumber’s salary. And when you’re small, you’ll stay small. No HNW will invest 7 figures in a fund where his assets are >50% of the fund’s assets. You’ll never grow by investors.. Your friends and family is the ceiling. Funds should be created the right way which is to work for a reputable buyside firm, do that for 5 years at a minimum of $20 million under management in your book. Once you hit $50m, which is the line in the sand, people will find you. For you, join a right prop firm. They will be your investor and increase your assets based on performance. After a year, they’ll raise you millions in buying power at a much higher payout too. If you really do have what you claim in terms of returns past 2 years, many firms in Chicago and Ny will back you.”

Could you please also respond to these remarks?

Nobody said it would be easy, Mark. Well, at least you shouldn’t listen to people who say it’s going to be easy…

There are many fair points here, and not in any way controversial or new. Yes, you need a large pool or money to manage if you want to make interesting money. 10m is really, really tiny, but it’s a start. I have a hard time seeing how you can make a decent living off 10, but you have to start somewhere.

While I see where they are coming from, whoever wrote these comments, I think they’re a bit overly pessimistic. Sure, it’s really, really hard. Sure, very few will make it. But clearly, those who let difficulties and poor odds scare them away, won’t even be in the race.

One point I disagree with, out of personal experience. That no one will take a stake of 50% of the aum. Sure they will. But it will cost you an arm and a leg, if they know what they’re doing. If they really believe in you, they might put up the capital or a large part of it, in return for an equity stake in the management company or a profit sharing agreement.

When you’re small, you have little room to negotiate. Expect to pay painfully much for your initial seed capital. But that’s what get you going.

Regarding ‘prop firms’, I know very little about them. I always suspected that this is a bit of a dodgy business, but I could be wrong…

Thank you for the answer. Much appreciated!

What do you think about such incubator funds at British Virgin Islands as a startup options? It would be for professional investors only.

“Fund requirements

An incubator fund has a minimum investment requirement of US$20,000, a cap on net assets of US$20M and limit of 20 investors. An incubator fund does not need to appoint an administrator, custodian, investment manager or auditor.

An approved fund has a net assets cap of US$100M and no more than 20 investors are permitted, but with no minimum investment criteria. An approved fund may operate without appointing a custodian, investment manager, or auditor, but will need an administrator.

Application process

Applications for approval as an Incubator Fund or an Approved Fund are made to the Commission and must be accompanied by:

the constitutional documents;

details of the investment strategy;

a prescribed form of investor warning; and

an application fee of US$1,500.

An Incubator Fund or Approved Fund can commence business 2 days from the date of receipt of a completed application by the Commission.

Duration and conversion of incubator fund

An Incubator Fund has a limited life of two years which can be extended for up to 12 months. An Approved Fund has no such limits. An Incubator Fund can convert to an Approved Fund, a private or professional fund, or may wind up at the end of its term. An Incubator Fund can convert to a private or professional fund or to an Approved Fund by making an appropriate application to the Commission.”

Cost of operations and startup is very low and after successful few years track record one could move to more reputable jurisdictions… but when you don’t have 20 million, one has to be creative… with lowered incentive/admin fees than industry standard…

Or it is a waste of time after 2008 and nobody would invest in this jurisdiction?

More info I found here: https://www.collascrill.com/documents/factsheets/cc-bvi-incubator-and-approved-fund/

I’m going to be very careful not to give any sort of regulatory or legal advise here. Anyone who is looking to start up should get independent legal advise on these topics.

Very generally: The industry as a whole has been increasingly moving to onshore business models. Regulations are getting tighter, compliance is much more of an issue than it was a decade ago. Rules are getting complex and costs are going up.

My understanding, based on a scientific approach called ‘talking to local friends’, is that it’s much easier and cheaper to set up and run a fund or similar in the United States. On my side of the Pond, the islands which have based their entire economy on helping foreign firms to bypass financial and tax legislation are not very popular these days.

Personally, I try to avoid these kind of jurisdictions. But that doesn’t necessarily mean that everyone should. We’re all in different situations to begin with.

Great article Andreas, however it seems as if your approach the whole trading thing as a full-time thing. I suppose it can be ultimately, however, for someone starting out it can easily be a part-time thing. Most successful traders are self-starter, entrepreneurial types, most have many fingers in many pies so to speak. Trading is not for income. A trader needs another source of income to cover living costs. This is *really* important. Instead, trading is for compounding and growing a trading account. Building a track record, showing decent risk adjusted returns over a large enough period, growing a trading account to a decent size then ultimately approaching external investors.

Thank you Andreas for your time! Much appreciated, knowing how busy you are.